发布时间:2020/3/30 浏览次数::2036次

False statement of securities refers to that the obligor of information disclosure violates the provisions of the securities laws and makes false records or misleading statements that violate the truth of the major events in the course of securities issuance or trading, or that there is a major omission or improper disclosure of information when disclosing information the behavior of.

False statements of listed companies are the most common violations of the rights of small and medium shareholders. Financial fraud, incomplete information disclosure, and untimeliness of listed companies are not uncommon. Civil claims against listed companies are also increasing.

1. The core issues that investors care about

1. Should a lawsuit be filed?

From 2003 to 2018, the rate of investor litigation was on the rise. As an investor, if you become a qualified plaintiff, you should promptly file a lawsuit for the following reasons:

(1) The degree of information disclosure by government agencies and information disclosure in the securities market has gradually deepened, and the difficulty for investors to obtain pre-procedure information has been greatly reduced. According to the current Securities Law, Administrative Measures for Information Disclosure of Listed Companies, and other securities laws and regulations and stock exchange regulatory documents, there are clear and specific provisions on matters related to information disclosure of listed companies. In conjunction with the provisions of Article 17 of the Interpretation, investors can obtain most relevant regulatory information through the Internet, greatly reducing their cost of obtaining pre-procedure information.

(2) After 15 years of judicial practice, a relatively mature legal service market has been formed in this type of case area, and investors can choose according to their needs. After the announcement of the Notice in 2002, civil cases involving false statement of securities are still a new thing. Not only are judicial organs relatively unfamiliar with them, but they also have no practical experience in the legal service market dominated by lawyers. However, with the deepening of judicial practice, many classic cases and corresponding judgment rules have emerged in this type of case field, and a group of professional lawyer teams have emerged. The choice of investors can be said to be wider and wider.

(3) The judgment rules summarized by accumulating cases make this kind of cases more and more predictable at the practical level, which can effectively reduce the risk of litigation.

Then, based on the above reasons, if investors are judged to be eligible plaintiffs in this type of case, they should file a lawsuit as soon as possible.

2. Does it meet the conditions for prosecution?

Generally speaking, investors who meet the following three conditions are eligible plaintiffs in such cases:

(1) Investors invest in securities directly related to the false statements;

(2) The investor purchases the securities on or after the implementation date of the false statement and before the disclosure date or correction date;

(3) On the day of disclosure or correction of the false statement, the investor incurred losses due to the sale of the securities or sustained losses due to continued holding of the securities.

3. What is the winning rate after prosecution?

According to the "big data report" statistics of false statements in securities, the winning rate of such cases is 89.17%.

4. What is the general processing time?

Through the visual analysis of the trial period, we can see that the trial time under the current conditions is more within 30 days, with an average time of 100 days. (Long time)

5. Where to proceed

* From the perspective of level jurisdiction, Article 8 of the Interpretation stipulates that this type of case is governed by the province, municipality, municipality where the people's government is located, the city with separate plans, and the special people's court of the special economic zone. Trial jurisdiction.

* From the perspective of regional jurisdiction, Article 5 of the "Notice" establishes the basic principle that the plaintiff is the defendant in this type of case, that is, the place where the defendant resides has jurisdiction over this type of case. For investors who filed lawsuits against multiple defendants,

(1) Under the jurisdiction of an intermediate court with jurisdiction over the issuer or the listed company;

(2) If a lawsuit is filed against a false presenter other than an issuer or a listed company, it is under the jurisdiction of the intermediate court where the defendant resides;

(3) Where a natural person is the only defendant in a lawsuit, the intermediate court of the defendant ’s domicile shall have jurisdiction.

Generally speaking, under the jurisdiction of the intermediate people's court where the listed company is located, it will be more time-consuming and labor-intensive for investors to proceed with litigation.

2. Evidence collection

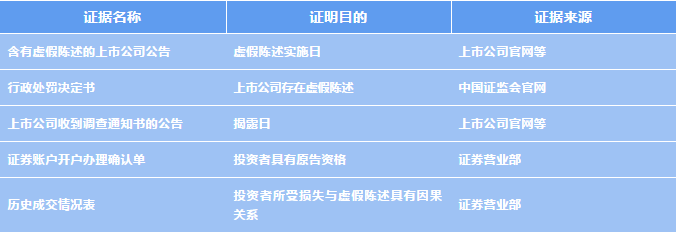

Investors should pay attention to collect the following evidence:

3. Legislation and legislative purpose

*legislation

1. The "Securities Law" promulgated in 1998 made prohibitive provisions on securities false statements, but from the current "Securities Law" which was revised once and three times in 2005, only two provisions The civil liability for false statements of securities is Article 69 and Article 173.

2. In the current trial practice, the most important basis for refereeing is:

(1) "Notice of the Supreme People's Court on Accepting Issues Related to Civil Tort Disputes Caused by False Statements in the Securities Market" (hereinafter referred to as "Notice")

(2) "Several Provisions of the Supreme People's Court on the Trial of Civil Compensation Cases Caused by False Statements in the Securities Market" (hereinafter referred to as "interpretation")

* Legislative purpose

The purpose of establishing an information disclosure system in the securities market is to overcome information asymmetry and enable investors to make rational choices with full knowledge, so as to optimize the allocation of scarce social resources. The act of misrepresentation is a violation of the obligation of information disclosure, which harms the interests of investors.

4. Common controversial focus of securities false statement cases

The civil compensation lawsuits caused by the false statements of listed companies are special in torts, causality, and exemptions.

The Supreme People ’s Court issued in January 2003 the "Several Provisions on the Trial of Civil Compensation Cases Caused by False Statements in the Securities Market" (hereinafter referred to as "Several Provisions of False Statements"), which is currently effective in handling disputes over damages for securities false statements The main legal basis. The focus of disputes in civil compensation litigation for securities false statements usually includes: whether the false statement is of material importance; the determination of the implementation date and disclosure date (or correction date) of the false statement; the determination of the base date and reference price; the determination of the causal relationship; Elimination; calculation method of investment loss and determination of loss amount, etc.

(1) The "significance" of falsely stated information

1. The information that constitutes the false statement must be a major event that violates the truth

Article 17 of the "Some Provisions for False Statements" states: "False statements in the securities market refer to the fact that the obligor of information disclosure violates the provisions of the securities laws and makes false records and misleading facts against major facts in the course of securities issuance or trading. Statements, or major omissions or improper disclosure of information when disclosing information. "

According to the above regulations, the object of a false statement in the securities market must be a "significant event". President Yang Linping of the Second Civil Chamber of the Supreme People's Court specifically pointed out in the "About Certain Issues in Current Commercial Trial Work" (hereinafter referred to as "Commercial Trial Issues") published at the end of 2015 that major issues of securities infringement should be studied. Materiality refers to the possible impact of illegal behavior on investors' decisions. Its main measurement index can be judged by the impact of illegal behavior on the price and volume of securities transactions.

In order to make the standard for determining the seriousness of false statements more operable, Article 17 of the "Several Provisions of False Statements" provides a further explanation of the scope of "significant events": Article 19, Article 60, Article 61, Article 62, Article 72 and related regulations. "Among them, Article 67 of the Securities Law (as amended in 2014) The listed methods clarify the "significant events" that may significantly affect the stock trading prices of listed companies, including:

(1) Major changes in the company's business policies and business scope;

(2) The company's major investment behavior and major property purchase decision;

(3) The company enters into an important contract, which may have an important impact on the company's assets, liabilities, equity and operating results;

(4) The company has major debts and fails to pay off due debts;

(5) The company has suffered major losses or significant losses;

(6) Major changes in the external conditions of the company's production and operation;

(7) The company's directors, more than one third of supervisors or managers have changed;

(8) Shareholders or actual controllers holding more than 5% of the company's shares have undergone major changes in their shareholding or control of the company;

(9) The company's decision to reduce capital, merge, split, dissolve and file for bankruptcy;

(10) Major lawsuits involving the company, the resolutions of the shareholders' meeting and the board of directors are rescinded according to law or declared invalid;

(11) The company's suspected crime was investigated by the judicial organ, and the company's directors, supervisors, and senior management personnel were taken compulsory measures by the judicial organ for the suspected crime;

(12) Other matters stipulated by the securities regulatory authority of the State Council.

In addition, the standards for major information are listed in other relevant provisions of the Securities Law, the Company Law, the Provisional Regulations on the Administration of Stock Issuance and Trading, and other securities regulations, and are passed through a series of rules issued by the CSRC Embodied.

Generally speaking, the significance standard of false statements is a relatively vague concept. It is difficult to use accurate words to outline in the legislation. Therefore, in many cases, the court needs to make a judgment in a specific case.

2. Relevant jurisprudence on the issue of "significance" of false statements

In the retrial case of Ying Zhongming et al. And Huawen Media Investment Group Co., Ltd. (hereinafter referred to as "Huawen Company") for disputes concerning the liability for securities false statements, the Supreme People's Court disclosed the amount and events involved in the financial accounting report disclosed by the involved information. Comprehensive judgment on the nature, influence and other aspects, and found that Huawen Company adjusted the relevant data in the 2008 annual report, except for the adjustment of the net profit attributable to the parent company ’s owner (up by 13.18%) and the total profit (up by 5.16%) In addition to the large range, the adjustment range of the other subjects is very small, and it cannot have a substantial impact on the stock market. The information disclosed by it does not constitute a major misstatement, and its information disclosure behavior does not constitute a false statement.

(2) Causality

The civil compensation litigation caused by the misrepresentation is first of all a civil infringement litigation. Therefore, the infringement of the false statement must meet the requirements of the general civil tort, that is, behavior, result, causality and fault.

The “Securities Law of the People ’s Republic of China” (hereinafter referred to as the “Securities Law”) has no provisions on causality, and “Some Provisions of the Supreme People ’s Court on the Trial of Civil Compensation Cases Caused by False Statements in the Securities Market” (hereinafter referred to as “Several Provisions”) ) Articles 18 and 19 define the establishment of causality from positive and negative aspects, respectively.

Causality is an important component of confirming tort liability, and the plaintiff generally bears the burden of proof. In the securities misrepresentation compensation lawsuit, considering the serious asymmetry of information between investors and listed companies, Article 18 of the "Several Provisions on the Trial of Misrepresentation Cases" stipulates the presumption principle of causality. "With the following three conditions, it should be To determine that there is a causal relationship between the false statement and the result of the damage:

(1) The securities invested by the investor are securities directly related to the false statement;

(2) The investor bought the securities on or after the implementation date of the false statement and before the disclosure date;

(3) On or after the day of disclosure of the false statement, the investor suffered a loss due to the sale of the securities or a loss due to continued holding of the securities "

Therefore, to determine whether there is a causal relationship between investment losses and false statements, the most important thing is to determine the date of implementation and disclosure of false statements.

(3) The issue of system risk identification in the securities market

Article 19, paragraph 4, of the "Some Provisions for False Statements" stipulates that the defendant provided evidence to prove that the plaintiff's loss or part of the loss was caused by other factors such as the securities market system risk. Causal relationship.

1. Definition of system risk in securities market

The aforementioned article regards system risk in the securities market as one of the conditions for exempting civil liability, but the concept does not clearly define the concept of system risk, which leads to large differences in law enforcement standards and recognition standards when courts in various regions determine this issue.

According to the general understanding of the securities industry, system risk refers to the risk factor that has a general impact on the securities market. It is characterized by system risk caused by common factors and affecting all stock prices in the securities market. This effect is for individual companies or industries. There is no control and investors cannot eliminate it by diversifying their investments.

The speech of the Vice President of the Supreme People ’s Court at the 2007 National Civil and Commercial Trial Working Conference “Full play of the role of civil and commercial trial functions to provide judicial protection for the construction of a socialist harmonious society” (May 30, 2007) stated: , Interest rates and other financial policies, domestic and international emergencies, changes in economic and political systems, and other systemic risks are common to all participants in the entire market or a certain area of the market, and this part of the losses incurred by investors It should not be borne by the person who made the false statement. "

2. Relevant jurisprudence concerning system risk in the securities market

In the case of Chen Lihua and other individuals v. Daqing Lianyi Petrochemical Co., Ltd. (hereinafter referred to as "Daqing Lianyi Company"), a dispute of false statement of liability, Daqing Lianyi Company submitted evidence of changes in relevant stock prices and the Shanghai Stock Exchange Index, claiming that investors' investment losses were due to systemic risks Caused. The Heilongjiang Provincial High People's Court ruled that since Daqing Lianyi Company made this claim, it should first prove the existence of the cause of systemic risk, but looking at all the evidence submitted by Daqing Lianyi Company to the courts of first and second instance, it cannot prove April 1999 From the 21st to the 27th of April, 2000, there were reasonable reasons for the stock market to affect the decline of all stock prices. Therefore, the court cannot accept Daqing Lianyi ’s claim that the investor ’s losses due to system risk deductions should be accepted.

3. The main points of judgment to determine the risk of the securities market system

According to the provisions of Article 19 of "Several Regulations on False Statements", the existence of systemic risks should be proved by the defendant. In practice, the defendant usually provides stock market index data as evidence to prove that the plaintiff ’s loss or part of the loss was caused by systemic risk. However, in judicial practice, the court usually not only examines the fluctuations of the market index, but also requires the defendant to prove the specific risk incentives, including domestic and foreign economic environment, political environment, domestic financial policy, industrial policy, regulatory policy, natural disasters, etc. At the same time, the court will determine the proportion of the risk factors of the securities market system to the entire loss according to the specific circumstances.