发布时间:2020/3/30 浏览次数::465次

A few days ago, the Ministry of Finance published an article on the old news and directly sent words such as only-child, property transfer, inheritance, etc. to the hot search.

What does this document say? In summary, three sentences:

① The most economical inheritance according to law (no need to pay personal income tax);

② However, if the parents are alive and the house is not considered for sale again, the gift-to-price transaction is cost-effective;

③If the parents are alive and the house is considered for sale again, the transaction is more cost-effective than a gift.

Inherit the property of parents according to law, no personal income tax

After the personal income tax law was revised in 2018, the Ministry of Finance and the State Administration of Taxation successively adjusted some tax items. Some items in other income are adjusted to accidental income, and the tax rate is 20%.

Among them: For the free donation of real estate, the "Announcement" pointed out: The income received by the recipient due to the free donated house is "incidental income", and the tax rate is 20%.

for example:

Taking a house with an area of 100 square meters and a value of 2 million as an example, there are two ways of free gift and sales, which one pays less taxes?

① If it is a sale, the main taxes and fees paid by the purchaser are: deed tax (the payment rate is 1.5%); stamp tax (0.05% of house purchase expenses). Adding these two main taxes, the buyer has to pay 31,000 yuan;

② If it is a gift, the recipient must pay 400,000 yuan in personal income tax.

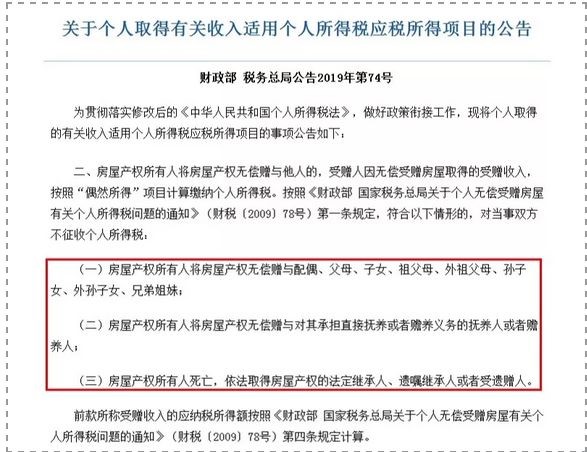

However, personal income tax is not levied under the following circumstances, including:

① The owner of the property rights donates the property rights to the spouse, parents, children, grandparents, grandparents, grandchildren, grandchildren, siblings (immediate blood relatives within three generations) free of charge

② The owner of the property right of the house grants the property right of the house free of charge to the caregiver or supporter who bears the obligation of direct support or support;

③ If the owner of the property right of the house dies, the legal heir, testamentary heir or bequeathor who acquired the property right of the house according to law.

Summarized as follows:

In the following two situations, children do not pay taxes

1. Inherit the property according to law

2. Parents give the property to their children

but! It's a good thing to take your parents' real estate for nothing, only in your dreams. In addition to individual taxes, the following taxes and fees need to be borne.

After the personal income tax law was revised in 2018, the Ministry of Finance and the State Administration of Taxation successively adjusted some tax items. Some items in other income are adjusted to accidental income, and the tax rate is 20%.

Among them: For the free donation of real estate, the "Announcement" pointed out: The income received by the recipient due to the free donated house is "incidental income", and the tax rate is 20%.

for example:

Taking a house with an area of 100 square meters and a value of 2 million as an example, there are two ways of free gift and sales, which one pays less taxes?

① If it is a sale, the main taxes and fees paid by the purchaser are: deed tax (the payment rate is 1.5%); stamp tax (0.05% of house purchase expenses). Adding these two main taxes, the buyer has to pay 31,000 yuan;

② If it is a gift, the recipient must pay 400,000 yuan in personal income tax.

However, personal income tax is not levied under the following circumstances, including:

① The owner of the property rights donates the property rights to the spouse, parents, children, grandparents, grandparents, grandchildren, grandchildren, siblings (immediate blood relatives within three generations) free of charge

② The owner of the property right of the house grants the property right of the house free of charge to the caregiver or supporter who bears the obligation of direct support or support;

③ If the owner of the property right of the house dies, the legal heir, testamentary heir or bequeathor who acquired the property right of the house according to law.

Summarized as follows:

In the following two situations, children do not pay taxes

1. Inherit the property according to law

2. Parents give the property to their children

but! It's a good thing to take your parents' real estate for nothing, only in your dreams. In addition to individual taxes, the following taxes and fees need to be borne.

Let ’s start with the conclusion: parents are still alive, and they will have to sell houses in the future.

Reasons for reiteration: The taxes and fees involved in the sale and purchase of houses are mainly deed tax (payment rate is 1.5%); stamp duty (0.05% of house purchase expenses): personal income tax (tax rate of 20%, based on the difference between house purchase and sale calculation , And borne by the seller).

If a property with a market value of 2 million yuan is transferred through a transaction, as mentioned above, the buyer mainly bears the deed tax and stamp tax, which is roughly 31,000 yuan. Although the policies for different types of taxes vary from place to place, this number is still very informative.