发布时间:2020/3/30 浏览次数::2635次

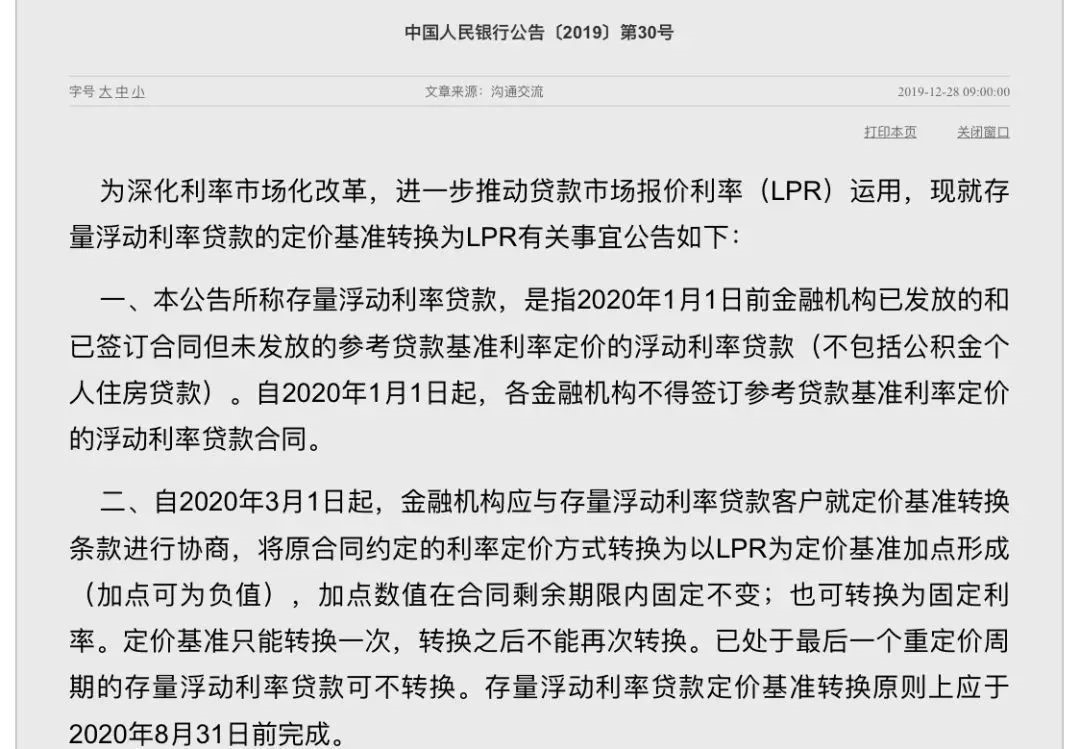

In early March, a number of banks issued announcements to officially start the conversion of individual stock floating rate loan pricing benchmarks to LPR. According to the announcement of the Central Bank, the conversion of LPR should in principle be completed before August 31.

First of all, this is a must-have for commercial mortgage slaves. Secondly, there is only one opportunity to choose, and there is no remorse. So, whether to choose LPR or fixed interest rate? Today we will come to clarify this issue.

1. What is "LPR"-Market Loan Interest Rate

LPR is the abbreviation of Loan Prime Rate, which is called the loan base interest rate in Chinese. At present, he is quoting from a total of 18 banks, large and small. According to their own capital costs and loan policies, these 18 banks give a loan rate that can give the best quality customers. Then Yang Ma, just like we usually watch the jury of the variety competitions, remove the highest price (point) and the lowest price (point), leaving 16 numbers, and take the arithmetic average to get the current LPR.

So don't think how advanced LPR is, it is actually a standard market-based loan interest rate.

Second, how to calculate the mortgage after linking LPR-LPR + plus point

Examples:

Xiao Wang has a 20-year mortgage with a remaining period of 16 years. In the past, the contract stipulated that the benchmark interest rate for loans over 5 years would rise by 10%, which is 1.1 times.

The original interest rate was: 4.9% × (1 + 10%) = 5.39%. The LPR over 5 years released in December 2019 is 4.8%. Xiao Wang's pricing will be based on LPR in the future, and his "plus point" is 5.39% -4.8% = 0.59%.

Xiao Wang's new mortgage interest rate calculation formula becomes: LPR + plus point, which is 4.8% + 0.59% = 5.39%. So in this pricing cycle, Xiao Wang's mortgage interest rate is calculated at 5.39%.

It should be noted that the "plus point" is the difference between your current interest rate level and LPR. It may not necessarily be a positive number, that is, increase the interest rate, but also a negative number, reduce the interest rate! But once this extra point is determined, it will not change during the remaining loan repayment time. By the beginning of the next pricing cycle, Xiao Wang's calculation of mortgage interest rates will change. The exact amount depends on how high the LPR will be.

Reminder: In the past, interest rates have risen, but after the reform, the interest rate is still high; in the past, interest rates have been discounted. After the reform, the interest rate is still low, and the discount is still valid.

3. How to choose—LPR

So, is it cost-effective to switch LPR or fixed-rate? This mainly depends on the trend of mortgage interest rates in the future repayment period.

At present, many western countries have even entered the era of negative interest rates. From the domestic situation, in the 1990s, the mortgage interest rate frequently exceeded 10%, and the benchmark mortgage interest rate was close to 7% 10 years ago, but now it is less than 5%. Not surprisingly, the future will continue to decline. Based on this background judgment, LPR is a wise choice.